“Serving Those Who Served" - How to Buy a Home with a VA Loan in Maryland

How to buy a home with a VA loan

If you’re a veteran, active duty service member, or surviving spouse thinking about buying a home in Maryland — particularly in the Harford County or Cecil County or surrounding area — the VA home-loan benefit could be one of the best tools at your disposal. With options like no down payment and no private mortgage insurance (PMI) (in many cases), the program removes some of the biggest barriers to homeownership. In this guide, we’ll walk you through:

-

How a VA loan works

-

What amount of money you might need up front

-

What the “maximum” priced home you can purchase with a VA loan in Maryland looks like

-

A link to a VA-loan calculator so you can estimate costs

-

Tips for VA buyers

-

The step-by-step process for a VA buyer

-

And specific insights for Maryland (including Harford & Cecil counties) to simplify the process.

How a VA Loan Works

The benefit of a VA loan comes from the guarantee by the U.S. Department of Veterans Affairs (VA) to the lender — that guarantee lowers the risk for the lender and allows better terms for you. Veterans Affairs+1

Here are the important features:

-

You don’t always have to make a down payment. In many cases you can purchase with 100% financing if you qualify. Capital Bank+1

-

You typically don’t have to pay PMI (private mortgage insurance), which conventional zero-down loans usually require. Capital Bank

-

You still need to qualify based on credit, income, and occupancy — the lender (not just the VA) determines what you can afford. Veterans Affairs+1

-

When you buy a home with a VA loan in Maryland, the typical local process applies (pre-approval, find home, appraisal, underwriting, closing) just like any other purchase loan. The difference is the program perks and eligibility criteria.

What Amount of Money Is Needed for a VA Loan

One of the biggest questions is: How much cash do I need to bring to closing?

Here’s a breakdown:

-

Because many VA loans permit zero down payment, you may not need a large down payment. Living In Maryland

-

But you do need to cover closing costs (though some can be negotiated or paid by the seller).

-

You’ll likely need funds for things like: earnest money deposit, inspection or appraisal gap if any, reserves required by your lender, moving costs, maybe prepaid items (insurance, taxes).

-

Also consider the VA funding fee (unless you’re exempt) — this is a percentage of the loan amount and can often be rolled into the loan but may affect your cash needed at closing.

-

Because you still need to qualify on income/debt, having reserves (extra savings) improves your chances of approval and may help your interest rate.

What Is the Maximum Priced Home You Can Get with a VA Loan in Maryland

This is a frequently asked question: “How much house can I buy with a VA loan?”

Here’s what you should know:

-

The VA sets loan limits only for the amount of loan they guarantee when you have partial entitlement. If you have full entitlement, there is effectively no maximum home price set by the VA — you are limited by what the lender will approve and by the home’s appraised value. Freedom Mortgage+1

-

In Maryland, for many counties the 2025 baseline limit (for partial entitlement) is $806,500 for a single-family home. VA Loans+1

-

Some higher-cost counties in Maryland have elevated limits (for example up to ~$1,209,750) for zero-down eligibility when partial entitlement applies. ValoAn Network+1

-

What this means for you: In Harford County or Cecil County, if you have full entitlement (i.e., you haven’t used your VA loan benefit before or you’ve paid off your previous VA loan and sold the home) then you can shop for homes at any price that your lender and appraiser approve. If you have used your benefit and still have entitlement remaining, you’ll want to check the specific county limit and how much entitlement remains.

VA Loan Calculator (Estimate Your Costs)

It’s helpful to plug in numbers so you can see what your home purchase might cost monthly and upfront. One good tool is the 2025 VA Loan Limit Calculator from Veterans United Home Loans — you can find it here: (Again,I've included this calculator link but PLEASE know I am NOT recommending Veterans United or any other national company)

VA Loan Limit Calculator – Veterans United Veterans United Home Loans

You can also look into general mortgage payment calculators (including down payment, interest, taxes, insurance) and manually factor in veteran-specific benefits (zero down, no PMI).

By using this calculator, you’ll be able to estimate:

-

What price home you could qualify for

-

What your monthly payment might look like

-

How much cash you’ll need at closing (approximate)

-

How changes in down payment (if you chose one) or interest rate would affect your payment

Tips for VA Buyers

Here are several actionable tips you should share with veterans considering a VA home loan:

-

Get your Certificate of Eligibility (COE) early. This is proof to your lender you are eligible for the benefit. Veterans Affairs+1

-

Shop for a lender experienced in VA loans. Because VA rules differ from conventional loans, you’ll want someone familiar with the program. *PLEASE ask me for recommendations on VA lenders!! (I have worked with many VA lenders & my clients have had great experiences & some.......the complete opposite. Don't assume the national companies are the best to work with.

-

Check your credit and debt-to-income ratio. Even though the VA has flexible rules, your lender will still review your ability to repay.

-

Consider having a reserve in savings. It strengthens your application and gives you a buffer after purchase.

-

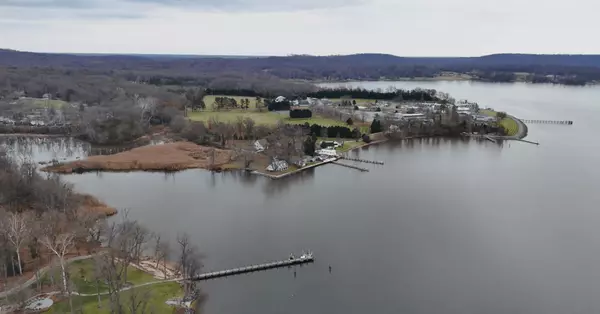

Know what your local market looks like. In Harford and Cecil counties, if waterfront or condo properties are your focus, make sure the property qualifies under VA guidelines (condos must be VA-eligible, etc).

-

Use your benefit smartly. You can reuse your VA loan benefit if you’ve paid off a previous VA loan or sold the home — ask your lender about remaining entitlement.

-

Negotiate closing costs. In many cases, the seller can cover some or all of your closing costs; combined with zero down, it can make a big difference.

-

Understand the funding fee. Unless exempt, you’ll pay a VA funding fee (which may be rolled into the loan) — know how that affects your overall cost.

-

Get pre-approved before you start serious house hunting. That gives you a realistic budget and shows sellers you’re serious.

-

Work with a Realtor who understands VA loans and your region. Since I’ve specialized for 19 years in Harford, Cecil & Kent counties, including waterfront and condo properties, I’d be glad to guide you through properties where VA financing fits.

Step-by-Step Process for a VA Buyer (I am honored to work with our vets; so I hope you will give me a call: 484-333-3518)

Here’s a simplified sequence of steps you’ll go through when purchasing a home with a VA loan. For veterans buying in Harford or Cecil County, you can follow this path with your Realtor and lender:

-

Determine eligibility & get COE – Check your service history, get your Certificate of Eligibility from the VA.

-

Find a lender & get pre-approval – A VA-experienced mortgage lender will review your credit, income, assets and give you a pre-approval amount.

-

Begin house-hunting – Work with me to locate homes that meet your criteria (location, price, condition, VA-loan eligible property).

-

Make an offer – You sign a contract for purchase, contingent on your financing and appraisal.

-

VA appraisal & inspection – The property is appraised and inspected to ensure it meets VA minimum property requirements. Benefits

-

Underwriting and final loan approval – The lender reviews documentation (employment, assets, appraisal) and issues final approval.

-

Closing – Sign all mortgage documents, pay whatever closing costs are due (or have seller pay them if negotiated), and the home is yours.

-

Move in & enjoy homeownership – As long as you meet your loan requirements (occupancy, payments) you’re good to go.

Why Choose Me to Help You (Local Expertise)

With 19 years of experience, over $3 million in commissions, and 150+ 5-star reviews, I, Julie Strickler of RE/MAX Vision, specialize in helping veterans and service members purchase homes in Harford County, Cecil County, and surrounding areas — including waterfront properties, single family homes, condos and townhouses.

If you’re using a VA loan or exploring your benefit, I know the market and VA-loan eligibility requirements — and I’ll help connect you with lenders, inspectors, and all the local support you need.

Visit my website at: https://juliestrickler.com to browse VA-eligible listings or schedule a free consultation. 484-333-3518 or Julie@StricklerTeam.com

Frequently Asked Questions (FAQ)

Q: Do I need to put money down with a VA loan?

A: Often no — if you have full entitlement and the home appraises for the purchase price, you may not need any down payment. Living In Maryland

Q: What if the home I want costs more than the “loan limit”?

A: If you have full entitlement, the loan limit doesn’t apply as a cap on purchase price — you’re instead limited by what the lender will approve and the appraised value. VA Loans+1

Q: Can I buy a condo or waterfront home with a VA loan in Maryland?

A: Yes — but the property must meet VA eligibility for the loan (condo must be VA-approved, condition must meet VA requirements). I’ll help you evaluate those properties in your search area.

Q: How many times can I use my VA loan benefit?

A: You can reuse it. If you’ve paid off your previous VA loan OR sold the property and paid off the loan, you likely have full entitlement again. Always check with your lender.

Call to Action

If you’re ready to explore buying your next home using your VA loan benefit, let’s connect. I’ll walk you through the process, help you find VA-loan eligible properties, and build a plan that fits your timeline and goals.

Contact me today at 484-333-3518 or email: Julie@StricklerTeam.com and let’s get you pre-approved, then get you into a home you deserve.

Thank you for your service, and thank you for trusting me to help you with your home-buying journey. I look forward to working with you.

Julie Strickler, RE/MAX Vision

484-333-3518

Julie@StricklerTeam.com

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "